Our Mission in Action

Since 1913, The Rockefeller Foundation and its partners have made big bets to break down barriers to progress and improve billions of lives with advances in public health, food, energy, and finance. Here are our stories:

- Latest Grantee Impact Story

An AI-Powered App Fights Climate Change While Revolutionizing Farming

An AI-powered mobile phone app is helping rural farmers in central India improve crop yields with planet-friendly guidance.

- Grantee Impact StoryPeriodic Table of Food Lays the Ground for a Health Revolution

The Periodic Table of Food Initiative will revolutionize health and nutrition by bridging the knowledge gap in food biomolecules.

- Deep Dive SeriesEarth-Engaged Teachers Shape Tomorrow’s Stewards

A five-part series looks at trailblazing teachers across the globe creatively adding climate change to the curriculum.

- Grantee Impact StoryA Food Bank on the Frontlines of Conflict Keeps Delivering

Civil unrest threatened to interfere with the work of Ecuador's oldest food bank. But the team wouldn't let it happen. And don’t miss the companion story from Ghana!

Committed Grants Explore our current and past funding priorities aimed at fostering and enhancing human potential.

Focus Areas From energy, food, health, and innovation, investigate our current global efforts.

Reports We believe in metrics, not only to celebrate successes, but to find ways to do better. Read our reports.

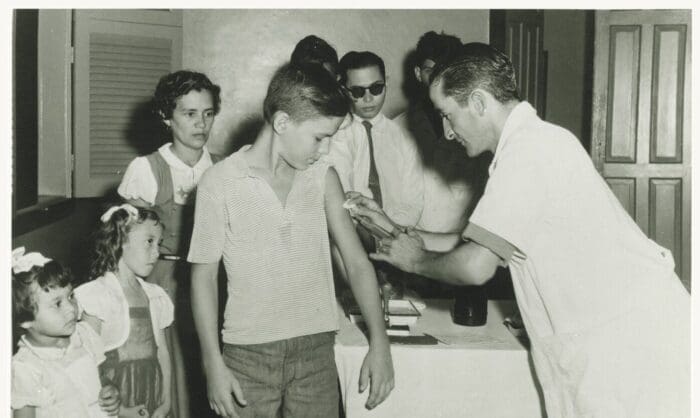

Historical Impact & Contributions

From our initial grant to the American Red Cross a century ago, The Rockefeller Foundation’s history is marked by bold initiatives, breakthroughs, and unique partnerships, driving transformative change over the past 110 years.

Recent News

- Apr 24 2024New Scientific Resources Map Food Components To Improve Human and Environmental Health

- Apr 19 2024Energy Transition Accelerator Advances With New Secretariat, Expert Consultative Group

- Apr 18 2024Rockefeller Foundation Joins Mayor Adams and Cross-Sector Partnership To Reduce Food-Related Carbon Emissions