As delivered on Monday, September 4, 2023 in Nairobi, Kenya

Good afternoon. As you heard, my name is William Asiko and I’m the Vice President for The Rockefeller Foundation for Africa. And it gives me great pleasure to be the program director for this session on carbon markets.

I think we’ve heard many times today that Africa is at an inflection point. We’ve heard in the previous session how difficult it is for Africa to access finance for its development and energy transition. That Africa has a perceived risk that is higher than other regions of the world that have higher default rates for loans than we do. We have heard that Africa is at the center of calling for global financial architecture reform, largely because that architecture is in the hands of people outside of Africa.

Today, we are going to talk about a financial instrument that is in our hands as Africans. That we can control. That we can determine the speed and the scale at which it grows. And that’s why it gives me great pleasure to moderate or to be the program director of this session of Carbon Markets for the Global South.

Now carbon markets, like any other market, require the development of a whole ecosystem so that the value chain can produce the results that are desired. And today’s session will bring together speakers who will talk to each part of the ecosystem that is required to make carbon markets for the Global South successful. And it will focus on the African Carbon Markets Initiative, that is an initiative that has been launched right here in Africa and that is working today to develop carbon markets.

So today, we have very distinguished speakers who will speak to partnerships, who will speak to market intermediaries, who will speak to the private sector, and who will speak to different parts of the ecosystem that are required to build carbon markets today. And we will introduce them as they come on stage.

So let me talk a little bit about this market called carbon markets. They are an innovative solution that can play an important role in the global journey to net zero. They facilitate the sale of credits for emissions that are removed or avoided by a project to other parties. Companies, governments, individuals buy these credits to neutralize or offset for their emissions as they transition to net zero. And they typically buy these credits at a lower cost than reducing their emissions directly.

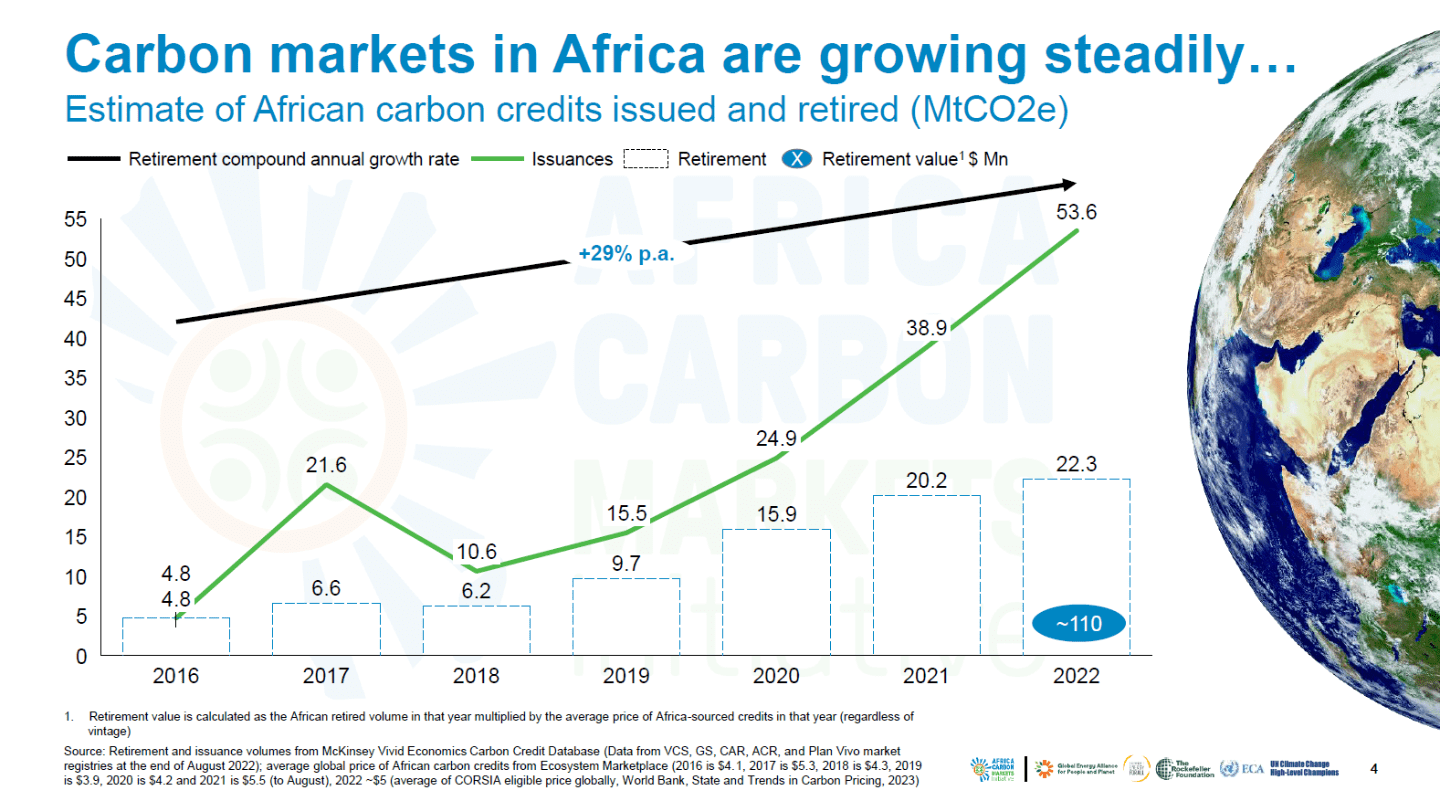

As a result, the appetite for carbon credits is growing, as you can see in the slide behind me. Global voluntary carbon markets have grown significantly over the past decade. And Africa’s voluntary market has grown 36% annually over the past five years. In 2021 alone, the market grew to a high of over $120 million in retirements.

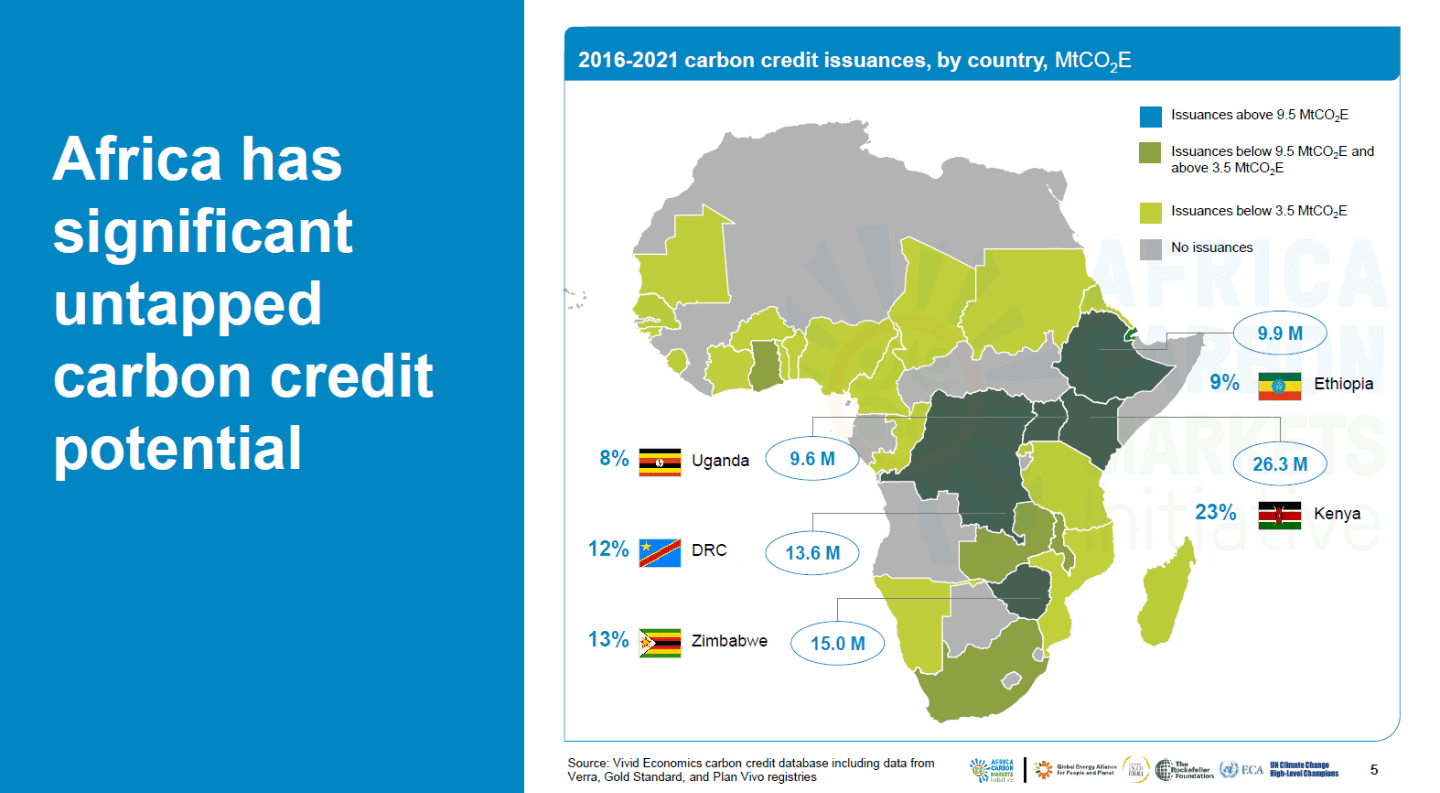

So carbon markets do represent a tremendous opportunity for Africa. The technical potential of Africa-sourced carbon credits is substantial. It is estimated at up to 2.4 [billion] tons of carbon dioxide, worth up to $50 billion annually by 2030.

Realizing that potential would deliver material benefits: Africans could mitigate climate change, protect critical ecosystems, and fund sustainable development for the region. Indeed, we could help our fellow Africans access clean energy and cooking, healthy food, invest in sustainable agriculture, pay for universal school feeding, and all of that would create millions of jobs.

And beyond the continent, Africa can become a global leader. Our carbon markets can serve as a template for others across the Global South and accelerate the transfer of financing from high-income countries to low- and middle-income countries.

However, even with the growth we have seen over the past five years, the continent is currently producing less than 2% of the maximum annual technical potential.

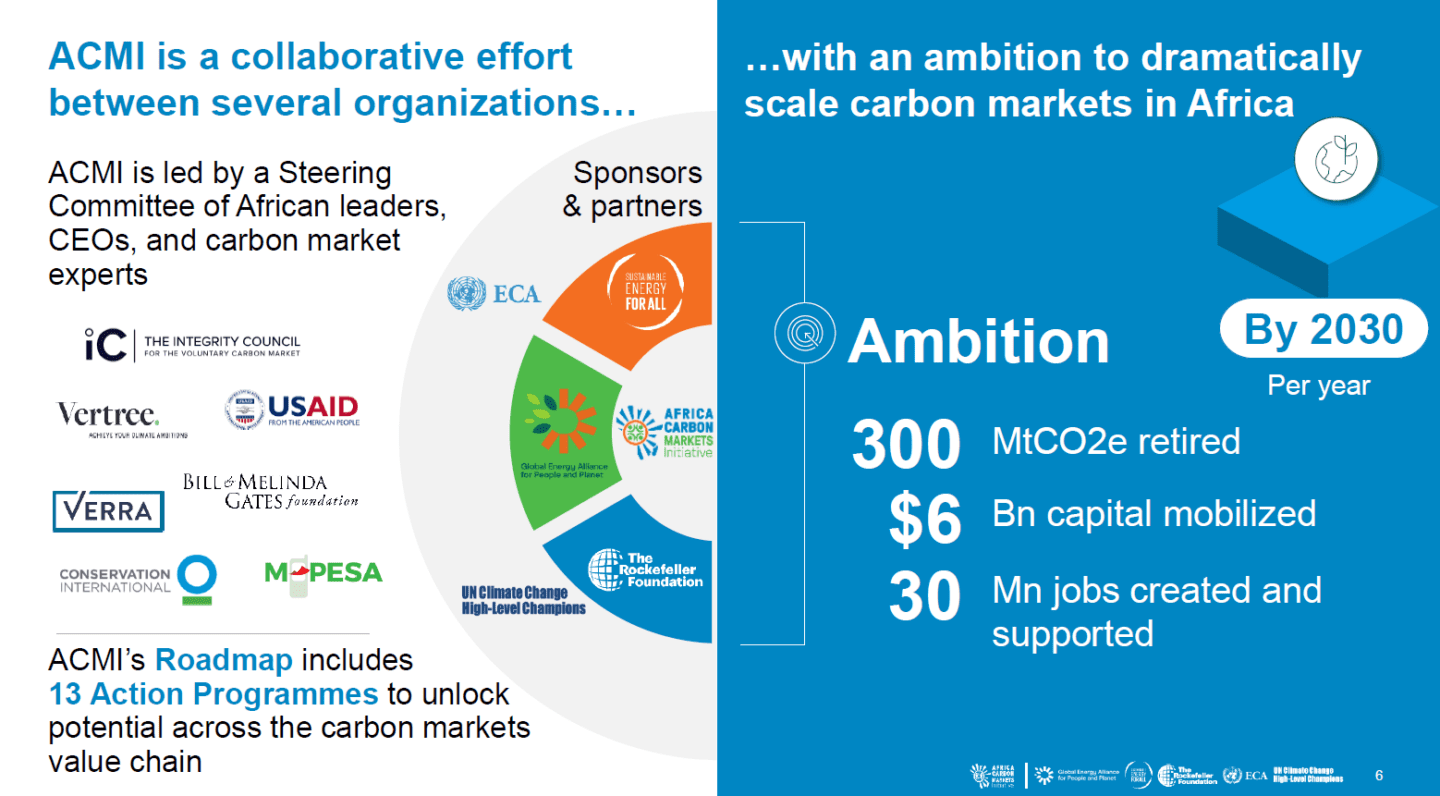

For this reason, The Rockefeller Foundation, Sustainable Energy for All, and the Global Alliance for People and Planet created the Africa Carbon Markets Initiative, or ACMI for short, to help realize the potential of voluntary carbon markets for Africa.

ACMI’s mission is to drive a 20-fold increase in the production of verified African carbon credits, while ensuring that their proceeds are transparently and equitably distributed. The integrity of carbon credits is central to this mission and ensures Africa can reliably meet the rising demand for credits.

We believe that, though there are plenty of global interests in individual schemes in different African nations, no umbrella organization exists to interact with, and objectively represent, African actors across the entire carbon market value chain, let alone uphold the integrity of traded credits. We set up ACMI to fill that role — to serve as an umbrella organization to scale carbon markets, run by Africans, situated in Africa, and representing African interests in the global market.

ACMI generated a lot of interest when we launched it at COP27, and I am pleased to report that we have made remarkable progress since then.

We have engaged more than 20 countries, six of which are on the brink of starting work to develop their carbon market infrastructure with ACMI’s support. The first of those is right here in Kenya, which worked with ACMI partners USAID and Sida to develop the country’s carbon market regulatory infrastructure.

We are also generating demand for African carbon credits. Major global companies, including Standard Chartered, Vertree, ETG, and Nando’s, have signed Advance Market Signals with a total value of $200 million. And I am pleased to say that in just a few moments, another major amount will be announced right here on this stage.

Three international exchanges and auction houses — for example, the Intercontinental Exchange, ICE, which owns the New York Stock Exchange — are preparing to host auctions of African carbon credits, with the Great Green Auction planned for COP28 in December. ACMI is working to sign Memorandums of Understanding with major financiers — such as Standard Chartered, the World Bank, the African Development Bank, and FSD [Africa] — to collaborate on financial mechanisms to increase capital flows into African carbon credit reduction projects. And we are drafting an inaugural Carbon Credit Showcase, which will drive transparency across Africa’s carbon credit supply by representing 92 projects from 63 developers across 23 countries.

And along the way, as I mentioned, we have prioritized integrity. Standards and integrity leaders — such as Gold Standard, ICVCM [Integrity Council for the Voluntary Carbon Market], VCMI [Voluntary Carbon Markets Integrity Initiative] — are prepared to put their own resources into collectively delivering on ACMI’s goals. That will include exploring the development of new methodologies in collaboration with ACMI.

We are indeed proud of the progress we have made as ACMI, and we are going to celebrate that progress today. But we know we still have a long way to go, which will be another focus of our discussions today.

So, without further ado, I will introduce our first speaker of the day, and I do have the honor of introducing the United States Special Presidential Envoy for Climate and former Secretary of State, John Kerry. As he comes up, let me just say that Secretary Kerry is here to give remarks on the Energy Transition Accelerator, or ETA, an inclusive multi-stakeholder climate finance platform to advance the global energy transition. Welcome, Secretary Kerry.