By directing historic investments into community banks, the EOC is expanding access to capital, empowering small businesses, and strengthening the foundation of a more inclusive, resilient national economy.

By the Numbers

- >0CompaniesCompanies

and organizations have joined the EOC

- $0MillionMillion

has been deployed by the EOC to date to unlock capital in low-income communities

- $0BillionBillion

in assets are CDFI-managed, creating jobs, affordable housing, and opportunity

Breaking Ground, Building Futures

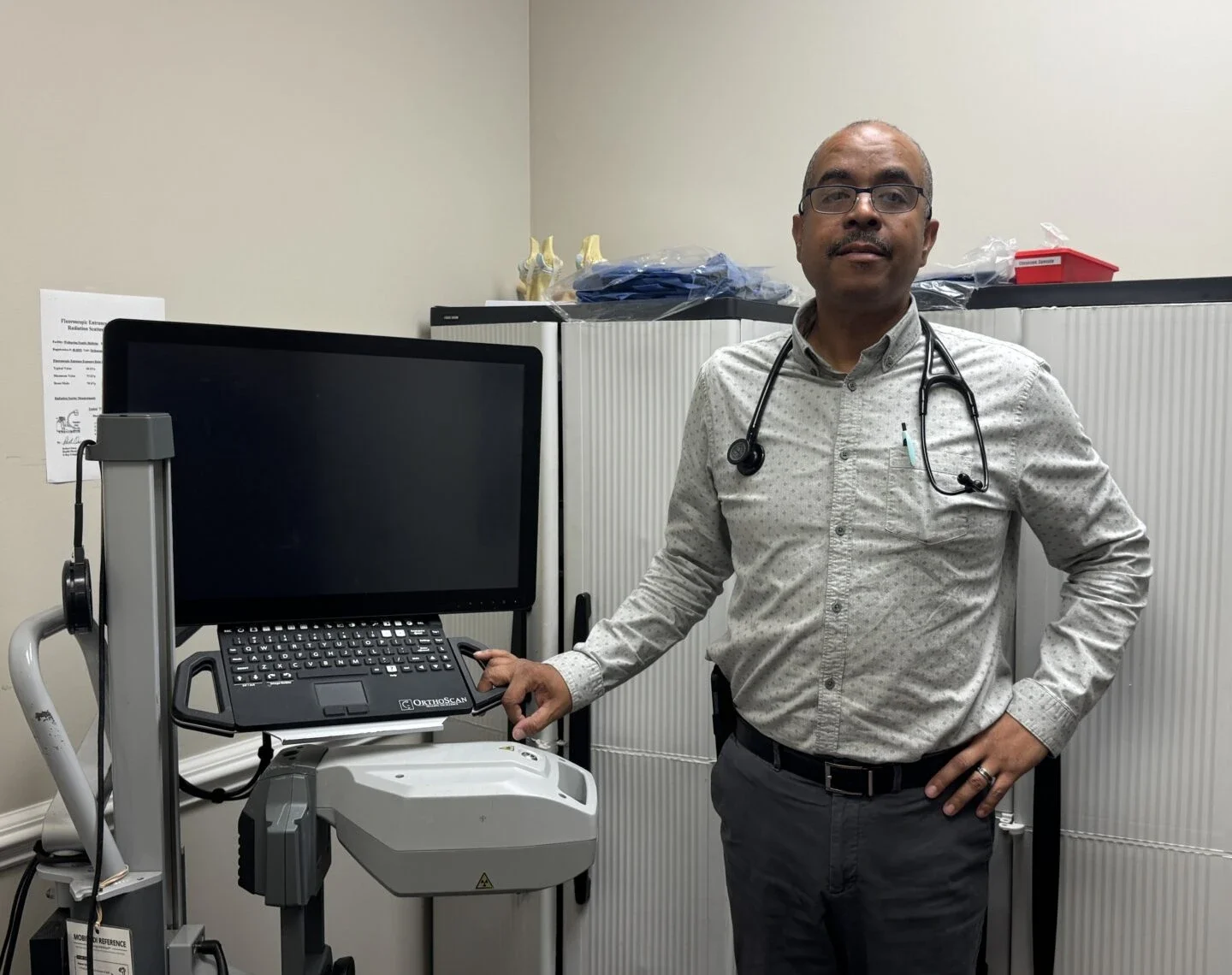

Rep. Dr. Jermaine Johnson, who represents South Carolina’s District 52 and is CEO of Dream Team Consulting, is another Optus champion. The bank worked with him to finance the purchase of 65 acres in rural Hopkins, 11 miles southeast of downtown Columbia, to develop into a solar farm and greenhouse.

“I went to my original bank first, but this was a unique project that took some time to understand, and they weren’t ready to help,” Johnson said. “When I went to Optus, they said, ‘This is unchartered territory, but I love the vision; let’s figure it out.’”

Johnson is developing an 11-megawatt solar farm with battery storage and electric charging stations.

The project will include a greenhouse growing okra and romaine lettuce that will be shared with the community and a chance to partner with the nearby middle school to offer its students horticulture classes.

“When I was a kid, my family was hit by the crack epidemic and then a gambling addiction,” Johnson said. “My older brother was killed when I was five years old. I went to seven different high schools and was homeless for a while, starting when I was about 14. My parents have never owned anything before either, so when I drove them out to see the property, there was excitement and some tears.”

Johnson views the Hopkins project as a template for other locations along the Interstate 95 corridor, referred to in South Carolina as the “Corridor of Shame” because of the inadequate resources for historically marginzalized schools and communities that straddle the highway.